Fomc Fed Funds Futures | Fed Funds Futures Nach Der Zinswende Cme Group Cme Group

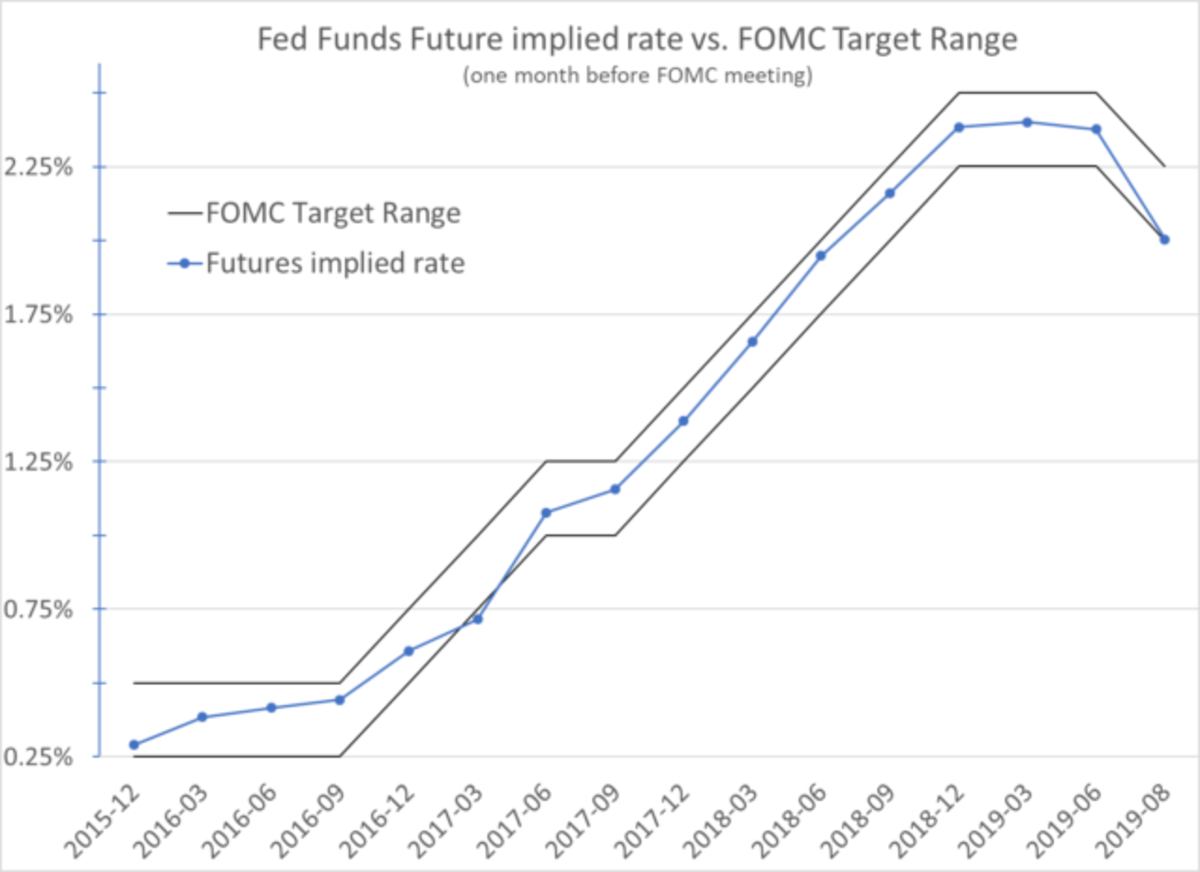

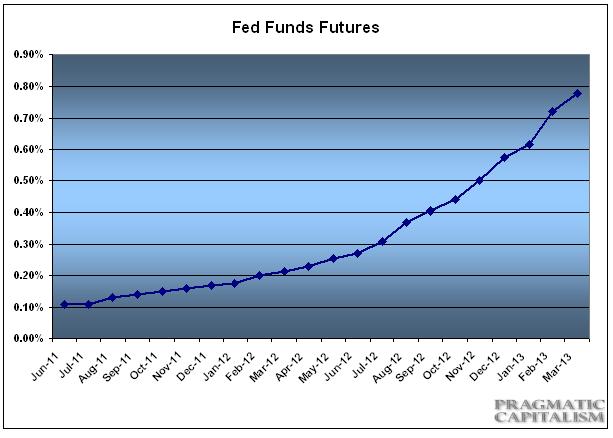

Contracts in the first 12 months typically represent the market view of FOMC policy. Federal funds futures are popular tools for calculating market-based monetary policy surprises.

Disciplined Systematic Global Macro Views What Are The Fed Funds Futures Telling Us About The Fomc

These allow market participants to hedge existing risks associated with changes to the Fed Funds rate or take a speculative view of upcoming FOMC action.

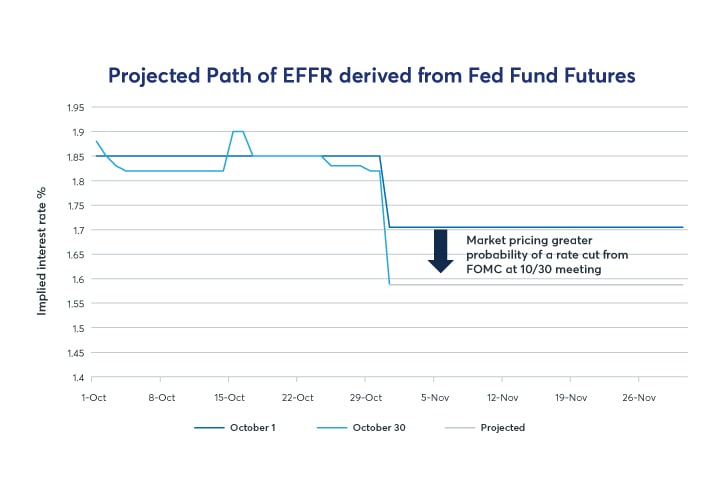

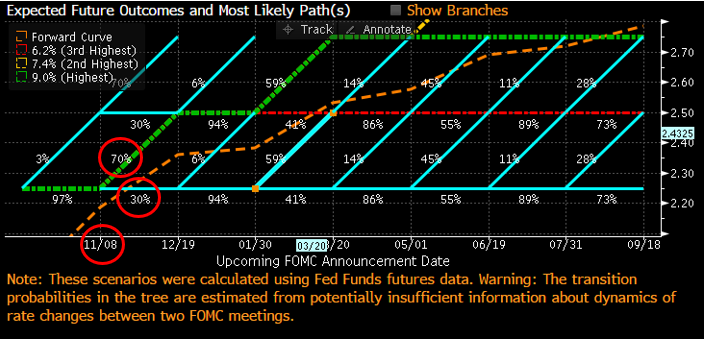

Fomc fed funds futures. Count down to the next Federal Open Market Committee FOMC rate hike with the CME FedWatch Tool based on the Fed Funds target rate. This paper demonstrates the use of federal funds futures contracts to measure how FOMC announcements lead to changes. 1 It is this Federal Reserve committee which makes key decisions about interest rates and the growth of the United States money supply.

These surprises are usually thought of as the difference between expected and realized federal funds target rates at the current FOMC meeting. FOMC Communication Policy and the Accuracy of Fed Funds Futures. CME Group lists 36 monthly Fed Funds futures contracts on its central match engine Globex.

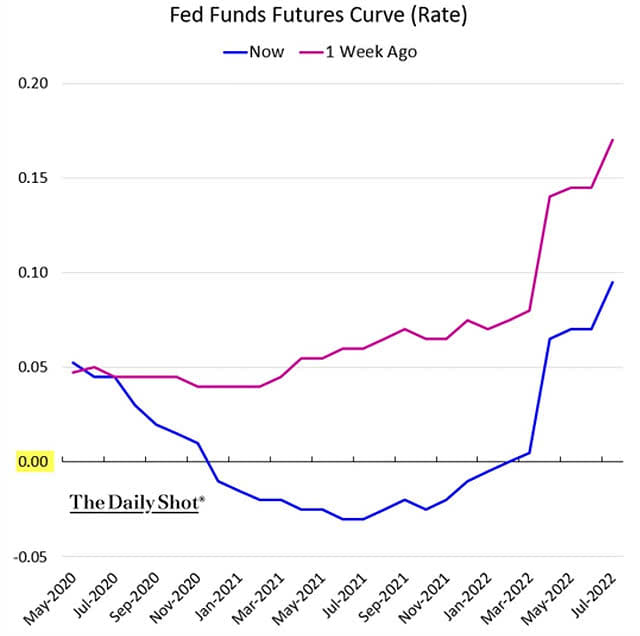

In other words this contract is backward looking. Over the last two decades the Federal Open Market Committee FOMC the rate-setting body of the United States Federal Reserve System has become increasingly communicative and transparent. 1 day agoStock futures were rising a day after the Fed pledged to keep its bond-buying program and ultralow interest-rate regime in place to support the economy and financial markets for now.

The Federal Funds FF futures contract provides a hedging tool for market participants. Efficient markets Trade in transparent markets with low transaction costs daily mark-to-markets and virtual elimination of counterparty credit risk. To determine the final value of a Fed Funds futures contract one must wait until the end of the contract month to determine its price.

Fed funds futures are financial contracts that represent the market opinion of where the daily official federal funds rate will be at the time of the contract expiry. Markets Home Active trader. Federal funds futures are popular tools for calculating market-based monetary policy surprises.

Fed Fund futures provide a gauge of market expectations about the Feds action at future FOMC meetings. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. According to policymakers one of the goals of this shift has been to improve monetary policy predictability.

The Fed funds futures strip has nearly priced in a hike at the September 2022 FOMC meeting. Either way Powell and the rest of the FOMC will likely attempt to. Again recall that the contract settles at the average effective rate weighted-average of.

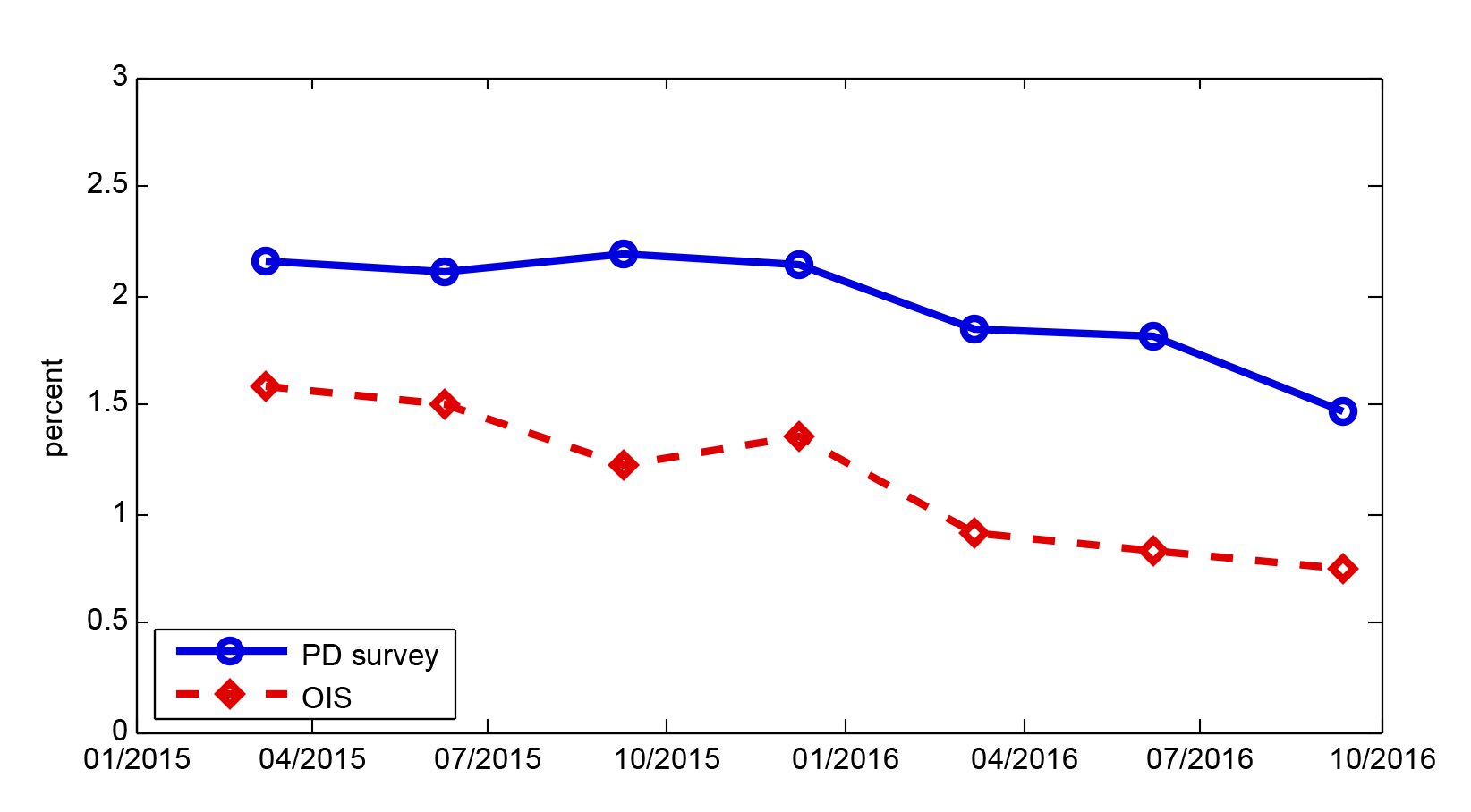

We show that futures-implied term SOFR rates have closely tracked federal funds OIS rates over the eight months since SOFR futures began trading. All four expect the Feds median dot to show no rate hikes through the end of 2022. To examine the performance of our approach over a longer time horizon we compare term rates derived from federal funds futures with observed overnight rates and OIS rates from 2000 to the present.

The Federal Open Market Committee FOMC a committee within the Federal Reserve System the Fed is charged under United States law with overseeing the nations open market operations ie the Feds buying and selling of United States Treasury securities. Since the Federal Open Market Committee FOMC sets the Fed Fund target rate the months when there is an FOMC meeting can be very important to contract pricing. 1 day agoFederal Reserve holds interest rates steady says tapering of bond buying coming soon Published Wed Sep 22 2021 200 PM EDT Updated Thu Sep 23 2021 1227 PM EDT Jeff Cox jeffcox7528.

These surprises are usually thought of as the difference between expected and realized federal funds target rates at the current FOMC meeting. Nothing contained herein constitutes the. 1 day agoThe Committee decided to keep the target range for the federal funds rate at 0 to 14 percent and expects it will be appropriate to maintain this target range until labor market conditions have.

Predictable Movements In Asset Prices Around Fomc Meetings Vox Cepr Policy Portal

Fed Funds Futures Nach Der Zinswende Cme Group Cme Group

Fed Funds Futures Nach Der Zinswende Cme Group Cme Group

Trading The Fed Why Fed Fund Futures Are A Key Barometer Thestreet

Fed Funds Futures Curve Interest Rates Isabelnet

Fed Funds Futures Nach Der Zinswende Cme Group Cme Group

The Grumpy Economist Futures Forecasts

Using Fed Fund Futures To Trade The Fomc Decisions Cme Group

Fed Funds Futures In A Post Zirp World Cme Group

Fomc Week Fed Fund Futures Curve All Star Charts

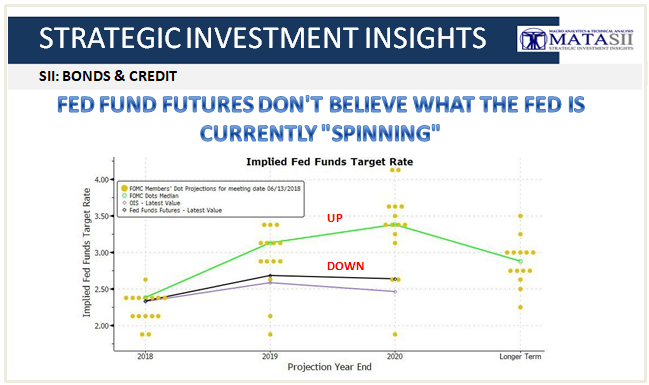

Fed Fund Futures Don T Believe What The Fed Is Currently Spinning Matasii

The Market Is Almost Always Wrong What The Fed Will Do Graphic

Fed Funds Futures Nach Der Zinswende Cme Group Cme Group

Frb Front End Term Premiums In Federal Funds Futures Rates And Implied Probabilities Of Future Rate Hikes

Introduction To Fed Fund Futures

What S Next For Fed Funds Atlas Capital Advisor Llc

Fed Funds Futures In A Post Zirp World Cme Group

Overnight Index Swaps Ois Vs Fed Funds Futures Quantitative Finance Stack Exchange

The Market Is Almost Always Wrong About What The Fed Will Do Chart Wolf Street